The point of research is to build assumptions that you can use in your outreach. For larger accounts, it's assumptions about their specific situation and the potential value of your solution. For personas or more broad-based campaigns, it's assumptions about their shared challenges and the potential value of your solution.

But where should you focus your attention & energy?

What do you need to know about target leads and accounts before launching your campaign?

And, what do you need to learn as you conduct your outreach?

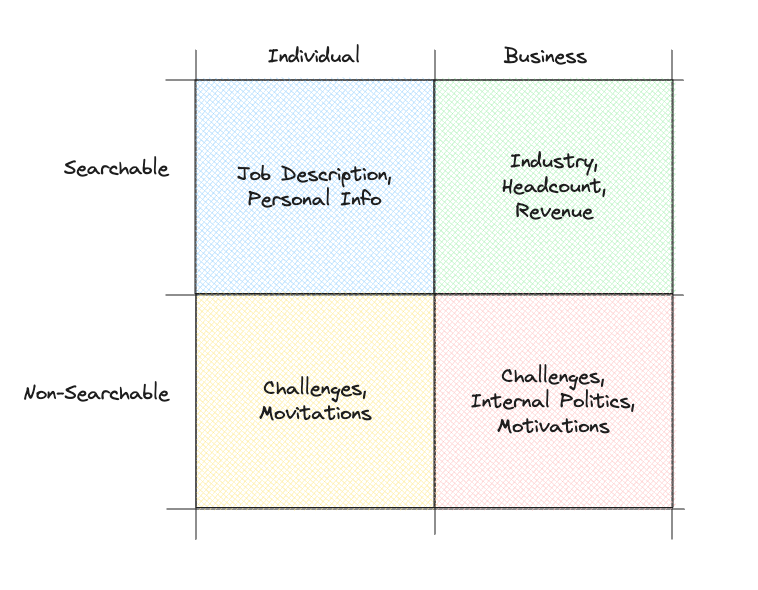

This is a very simple tool offered by Alex Newmann in Episode 43.

Searchable vs. Non-Searchable

Simply: what is publicly available? What isn't?

Individual vs. Business

In B2B, we sell to both. We need to know the individual we're reaching out to and the business we're trying to sell to.

Filling in the Grid

Searchable + Individual. This is data publicly available about the specific individual you're planning on reaching out to. Data enrichment tools can offer phone numbers and emails. LinkedIn can show you how long they've been at the company. A Google search can yield their exact job description or one very similar. They might even have podcast interviews or news articles with input if they're an executive.

Searchable + Business. This is data publicly available about the specific company you're planning on reaching out to. If they're public, this is information contained in their 8-K filings or their annual reports. Whether they're public or private, it also includes information on their website, inside LinkedIn Sales Navigator, and on news sites.

Non-Searchable + Individual. These are things to ID upfront, but that you won't know until you talk to the person. This includes their specific time-sensitive challenges in their role, their motivations in their job and their career, and their top priorities for the next 12 months.

Non-Searchable + Business. These are also things to ID upfront, but that you won't know until you talk to multiple people at the account or across the industry (see more on personas below). This includes the specific internal politics at that company, but also include the challenges the company faces in their competitive environment, their top internal priorities, and what leadership is pushing over the next 12 months.

Putting it Into Practice

Validating Non-Searchable Information in a Campaign

Let's start with the scenario of a sales campaign. This is where you're targeting multiple firms across a market segment, instead of just one large enterprise account. While the top-line goal of this campaign is to sell something, it's also to learn and validate the "non-searchable" assumptions across different firms.

If you tackle one market segment at a time (i.e. only financial services companies below 50 employees) over 2-4 weeks, it makes this process much much easier.

- Generate a list of target accounts in the market segment that meet general criteria of headcount, revenue, and industry

- Create a list of target individuals at those accounts that meet general ICP criteria of job titles and time in role

- Then, create assumptions regarding the challenges those target accounts face in the current market that would prompt them to be interested in your solution

- Then, create assumptions regarding the challenges those ICP personas face across all of your target accounts

The goal of your outreach is, in part, to validate those assumptions and create actual target personas you can use.

- If I'm selling attribution software to performance marketers, I can pull a list of target accounts and leads at those accounts. As a part of my outreach, I'm looking to use cold call openers and cold email openers that try and prompt a response so I can learn something about my assumptions in the "non-searchable" categories. That way, the more I do outreach, the smarter I get! The more knowledgeable I get about the people I sell to and the actual challenges that they face.

So even though I'm running an outbound campaign with the primary goal to book meetings that close deals, my secondary goal is to learn something about my target audience.

After 60 days, you can review your information and see what you've learned about your target market. What did you learn in the "non-searchable" squares that is generally applicable across the entire market segment? That is uniquely valuable insight you can use when selling to new accounts in the same market segment.

Validating Non-Searchable Information in Account-Based Sales

This is closely related to Mapping the Earthquake. The goal of account-based sales is to validate the specific non-searchable information at that account.

In enterprise sales, there will be generally applicable information (like what you learn in the sales campaign example) that you can use when starting conversations at other enterprise accounts in the same market segment. However, there will also be specific information that isn't applicable to other accounts. Consider a few examples:

- Specific CEO/CIO-led initiatives for digital transformation that require $X in investment over the next 3-5 years

- Specific policies about job titles or job title inflation that means, at that account, one role has more influence even though that's not normally the case

- Specific procurement procedures or other internal processes that have a specific impact on the deal

These are usually in the non-searchable + business square. The specifics of the business matter a lot when trying to break into an enterprise account and there will be plenty of assumptions you need to validate as a part of your prospecting and discovery efforts.

All of this information can be documented inside your CRM, inside a personal Google Doc, an Apple Note, or even pen & paper.

What's important is that you can review this information across multiple individuals and accounts after 60-90 days so you can identify patterns and similarities in the market segment. It will help you get better at prospecting as you go.

Do you know who you're reaching out to?

Do you have assumptions about their challenges in their job?

Do you have assumptions about how you might provide value?

Do you know what type of company you sell to?

Do you have assumptions about the challenges of that company currently?

Do you have assumptions about how you might provide value?