If you take a glance at some existing resources for account planning (say, HubSpot), you'll notice that building an account plan for an enterprise deal is often about knowledge gathering and research.

Most account plans for B2B enterprise prospecting take the approach of "general to specific":

- Start with general business objectives like corporate strategy, finance, size, and who they sell to

- Narrow in on key business priorities like a CEO's public initiative or a major product line strategy

- Map out power & influence in the organization by creating org structure charts and identifying key titles or personas in the account

- Link back an assumed challenge (or potential challenge) the company is experiencing based upon your research to a solution you offer – i.e. the value you provide in your product or service.

And then... go and try to sell it to the people you identified in the org chart by validating the assumptions you made based on your research. In theory, this works great as long as your research lines up with what they're actually experiencing.

What happens in reality? Most sellers go directly for the VP or product owner and get ignored.

The primary reason they ignore you isn't that your messaging is bad. It could be bad, but the more likely cause is that everyone else is doing this too. Back in 2014, it was a very novel approach to set up a nurture sequence for a product owner at a target company. People weren't overwhelmed by the number of emails they get and the world was a different place.

It's different today. We need to adapt the way we build our account plan and conduct our research, because it will change the way we approach and message our offer.

The Earthquake

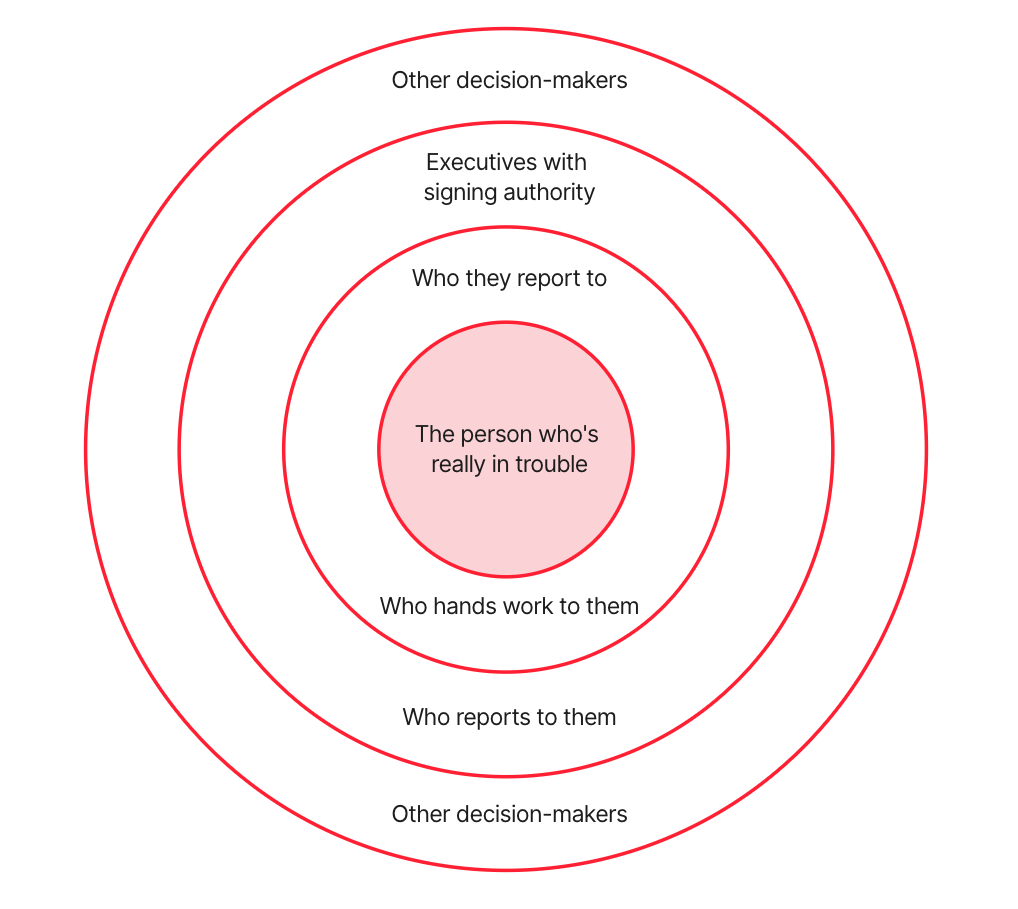

The Earthquake is a very simple exercise to identify the right people and the right areas for research. It builds a much more comprehensive and useful account plan. It looks like this:

Circle 1: The Person Who's Really in Trouble

This is the epicenter of the earthquake. This person or team are the end-users of your product.

Identifying this circle should be fairly straightforward. Who benefits the most from your solution? Remember: this person is likely not the buyer of your solution especially in an enterprise deal. They are further down the food chain in the organization.

Consider a few examples:

- At Alignd, we sell a LinkedIn implementation service to help teams integrate Sales Nav into their existing sales processes. The person who's in trouble without that? The poor individual account executive (AE).

- A client of ours works in healthcare IT. One product line is an analysis tool for big data sets, specifically designed for health insurance companies. The person who's in trouble without that? The poor manager who has to compile reports for their executive team.

- A company I know sells software & managed services to help hire internationally while staying compliant with laws and taxes. The person who's in trouble without that? Potentially a couple – but at the very least the poor HR team responsible for hiring.

Here's the hat trick: that person or team already has a workflow. Instead of a CRM, they're using an excel spreadsheet. Instead of a big data analysis tool, they're using a "frankenstack" that's super expensive and time-consuming to run. Instead of X, they're doing Y.

That workflow is broken (they're in trouble, after all, without your solution). And that broken workflow ripples out into the rest of the company. Mapping the earthquake becomes mapping the flow of pain inside the company.

Who is in the center of the earthquake?

What is their job title?

What's their existing workflow that you seek to replace?

Circle 2: Who They Report To + Who Hands Work to Them

Now we take one step outside the center of the problem.

Who do they report to? This is their boss. That boss cares about the outcomes of their work. Their current workflow allows them to accomplish the job "well enough" that the boss isn't angry at them, but they likely see (or hear) the pain of things not going well. A sales manager will notice underperforming sales reps. A product owner will notice a development team who's running behind. A marketing director will notice delayed campaign launches.

Who hands work to them? This is about identifying other teams or managers who influence their work. An easy example? Marketing hands off work to sales teams (inbound leads). Market research teams hand off work to product teams (new product features). Product teams hand off work to operations teams (new data sets need to be integrated).

The idea here is to identify the centers of the company that are directly impacted by the broken workflow.

- Let's say you sell attribution software. If a B2B performance marketer cannot correctly attribute lead sources, they can't generate accurate reports to optimize their lead funnel (Circle 1). Their boss might not notice because she's too busy with other things. But the sales ops team and sales managers absolutely will – marketing keeps on handing unqualified leads to sales to qualify. So sales ops will hand work back to them to try and get more targeted on who they're trying to reach (Circle 2).

- Let's say you sell cybersecurity monitoring in high-tech manufacturing. If that individual security analyst cannot get real-time monitoring, they cannot respond effectively to a cyber threat (Circle 1). Their boss is obviously going to care about this. But the plant managers and the digital transformation team leads will too – they hand-off work to the cybersecurity team to ensure plants are run efficiently without any major interruption (Circle 2).

Who do they report to?

What will the boss notice about the broken workflow, if anything?

What other teams hand them work?

What job titles exist in those other teams?

Circle 3: Executives with Signing Authority + Who Reports to Them

This is where most account plans usually start. The problem is these executives are too far removed from the broken workflow to truly understand the consequence. This is why you're struggling to break in. Chances are, that executive sees your email and thinks "oh great another product pitch," because they are too removed from the day-to-day pain to truly understand it.

It's important to identify these executives because they're the buyers. They approve the budget. They sign off on the deal. They need to understand the real challenge as it relates to the overall business use case.

Additionally, who reports to them? Focus your attention on the other teams identified in Circle 2. Does everyone report up to the same executive? Or, do you have multiple executives involved?

- Back to the attribution software example, the B2B performance marketer in Circle 1 gets handed work from the sales ops team. But, that sales ops team might report up to a VP of Sales or a CEO, depending upon the company. Selling attribution software might only require the sign-off of the CMO but it will influence outcomes elsewhere in the organization, so those other executives might have input.

- Back to the cybersecurity monitoring example, the security analyst might report up into the overall Chief Information Officer arm of the company. But so does the digital transformation team that hands them work. Yet the plant managers report up to the COO of the company.

It's important to include these now – or create some assumptions based on publicly available information that you validate later – because these stakeholders will have some influence on the overall deal.

Who are the executives that will sign off on this deal?

Who needs to know that this problem is occurring?

Who needs to know that this deal is happening?

Where do other teams report up to inside the company?

Are you dealing with one executive or multiple?

What are their job titles?

Circle 4: Other Decision-Makers

Finance and legal are obvious candidates for Circle 4, in particular the CFO. These are stakeholders extremely removed from the central workflow problem inside the company. They don't know much about what you sell, the problem you solve, or why the company should purchase the solution (unless you sell into finance or legal, that is).

But they will influence the outcome of the deal. In larger enterprises, these are the various stakeholders that can serve as "blockers" to the deal.

- Back to the attribution software example, that software will have to incorporate multiple internal, sensitive data sources. IT will definitely have a say here if the company is large enough.

- Back to the cybersecurity example, real-time monitoring interfaces with multiple layers of IT software in different divisions of the company. But it's also possible that DevSecOps or an internal software development team might have a say in what platform is selected.

Who else will influence the outcome of this deal?

What are their job titles?

Putting the Earthquake into Practice

By this point, you should have a document that answers:

- Who is in the center of the earthquake?

- Who do they report to? Who hands them work?

- Which executives will sign off on this deal? Who reports to them?

- Who else will influence the outcome of this deal?

Most of this is educated guesswork. You should be pretty confident about who is in the center of the earthquake and who they report to, as this dovetails neatly with any ICP or persona information your company hands you. Everything else is a first attempt that you then are validating during your prospecting.

Demand vs. Activation

Putting this account plan into action requires a shift in thinking from traditional selling. It's the difference between creating demand and activating accounts.

- Demand: Create a list of qualified accounts to be prioritized & activated

- Activation: Take a prioritized account and convert them into an opportunity

Creating demand means generating qualified leads, taking them from general awareness into consideration. Activation takes them from consideration through the sales process to a completed solution. In outbound enterprise sales, very few accounts are ready to be activated. They're not in a buying motion (and frankly if they are in the RFP stage, you're too late).

Our goal is to discover whether the account is qualified or not. That's it. Prospecting is research in action. It starts with an insight and ends with a champion. If you do not have a champion, it is not a qualified opportunity. It is not an activated deal.

Putting the Earthquake into practice helps us discover whether or not the account is qualified. Throw out all of your previous lingo about "routing in bottom-up" or "middle out" or however else you have thought about enterprise sales. We're going to route in through the flow of pain in the company.

Direct Outreach to the Center of the Earthquake

An individual account executive is a lot easier to get a hold of than the VP of Sales. An individual analyst is a lot easier to get a hold of than the CIO.

But! This individual who's in trouble is not usually your buyer. So can you pitch them? Nope. Can you talk about your product? No, they really don't care about it. Can you get them to book a 15 minute meeting to discuss their current challenges? Probably not.

What you can do: connect with them over a shared challenge. Gather intel. Validate assumptions about your Earthquake Map.

Hey Nick, noticed that your entire team is on Sales Nav. I've connected with a lot of sellers recently who say they got it from their company with zero training... sound familiar?? Haha, anyway, would love to connect.

Hey Morgan, noticed you all are running a bunch of LinkedIn ad campaigns! Talked with a bunch of performance marketers lately and a bunch are struggling to connect persona data back to CRM reports. Any pointers I could share?

Hey Nick, didn't know if this would be relevant, but I saw your company is spinning up some new plants (big initiative!) and can only imagine the security headache this is causing. Saw this article and thought of your work: {3rd party link}

These are just some example outreach messages you could send in an email or a LinkedIn DM. You might imagine how obeying the Vampire Sales Rule can transform these conversations with the primary end user (especially on message #2, which risks being a bait-and-switch). It gets you a lot of intel, you can ask honest questions – and get honest responses!

The primary goal is to uncover whether the company could be a good fit. Is their existing workflow what you expected? When you bring up alternative approaches, what's their response? Do they actually report to who you thought they did?

And most powerful of all: is there a situation similar to another that your company has already solved? Explore your case study library and see if there is a customer story that is similar to the situation they're experiencing.

Does the company have a dedicated workflow or is everyone doing it their own way?

How far up the food chain (seniority) is the problem known?

Do you have a 10x ROI solution that you have a case study for?

Building Out the Rest of the Business Case

Visa's founder Dee Hock said "judgement is only developed when used." Said another way: you might screw this up the first few times. That's okay!

There is no cut-and-dry method for routing elsewhere in the account. You can take this intel and go directly to Circles 2 and 3 to continue the conversation. If you developed strong rapport with the individual, you could ask for a referral elsewhere to continue exploring the account.

The primary goal is to continue building the business case. Nate Nasraslla from Fluint has an excellent guide (here) about building this written narrative and how to structure it.

Since we're still prospecting, the goal of building this business case isn't to share it around (just yet). It's to gather together insights, information, and assumptions into a format that you can eventually share with your champion. The Earthquake serves as your guide about who to talk to and what to validate. The business case becomes why they need to solve the broken workflow – and how (your solution).

Having these conversations with multiple members inside the Earthquake allows you to gather the right, validated intel to include inside the business case. You're working multiple angles and bringing together a compelling narrative to the executive buyer (Circle 3).

The secondary goal is to identify the top risks to be managed or mitigated for the sale to be successful.

These can vary depending upon what you're trying to sell. However, there are three very common ones:

- Leadership sponsorship. If you sell sales training and the existing VP of Sales has brought in your competitor 10 months ago, it's very likely they won't sponsor the sale. This risks slowing down the deal or stopping it dead in its tracks.

- Culture of the team. If you sell a project management tool for developers, it needs to be integrated into their workflow. Is the culture willing to change? How much executive sponsorship will be required to get the team on board to a new tool? Cultural resistance to change risks a slow deal or buying by committee.

- Management of the project. In enterprise sales, you're not selling a $20/mo subscription. The implementation of your solution is critical. Has the prospective company ever implemented something like your solution before? Has your buying committee ever purchased something in this industry before? Concerns and confusion about implementation presents the risk that an executive buyer doesn't understand what they're buying in the first place... and risks a slow deal or a deal that doesn't ever happen.

Identifying these risks up front allows you to effectively qualify the deal. If you actually do sell sales training and the VP of Sales brought in your competitor 10 months ago, maybe it's not a qualified opportunity!

Meanwhile, a deal with a buyer who hasn't bought something from your industry but has implemented a large transformation effort recently is a great indicator they could see value from what you sell. It helps when the CIO is probably on board too. That sounds like a qualified opportunity once you identify a champion for the deal.

Have you had discussions with multiple people in different circles inside the Earthquake?

Have you identified the potential users vs. buyers?

Can you articulate the potential ROI of implementing your solution?

What risks are there moving forward and are they managed?

Closing In on a Champion

Your champion might be the end user! It depends upon the political capital they hold inside the organization and what you're selling.

More often than not, it's somebody in that Circle 2 or Circle 3. An executive might buy-in to the vision you're selling and mobilize internal resources. A division director might immediately connect the dots and start making introductions to the rest of the organization. A manager sees the potential of what you're trying to sell.

Once you've gotten your champion, prospecting is over and you have a qualified opportunity.

This is where you transition out of exploring the earthquake and into buyer enablement. Nate Nasralla's episode 75 is an excellent exploration of how to do this properly

Mapping the earthquake is the easiest way to break into enterprise accounts. In practice, you'll notice that your messaging doesn't need to be 100% dead-on in order to have good conversations. Over time, you'll be able to take intel from the ground floor up to executives. They'll lean in, wonder how you got that information, and become impressed by your knowledge of the business. Centering your entire outbound motion on the pain they're experiencing, its consequences to the overall business, and how your solution provides direct value means much more meaningful conversations... and much quicker deal cycles.